By Bob West

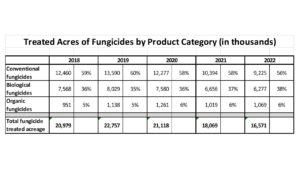

Farmers across the country have been steadily incorporating more organic and biological products into their crop protection programs, and this trend is evident in California as well, as seen in the PURE Intel data from Meister Media Worldwide. PURE Intel+™ and PURE Intel PCA (patent pending) are comprehensive databases providing subscribers with tremendous insights into California farmers’ crop protection programs. Full-year application data for 2022 shows 4,386,324 treated acres of organic products (defined as carrying the OMRI designation on the label) compared to 4,273,009 treated acres in 2021. (see chart below)

|

Application Type |

2020 | 2021 | 2022 | |||

| Treated Acres | % of Total | Treated Acres | % of Total | Treated Acres | % of Total | |

|

Conventional applications |

85.8 million | 84% | 77.2 million | 83% | 74.2 million | 83% |

|

Biopesticide applications |

12.4 million | 12% | 11.3 million | 12% | 11.0 million | 12% |

|

Organic applications |

4.5 million |

4% | 4.3 million |

5% | 4.4 million |

5% |

Interestingly, the farmers reported slightly more than 3,000 fewer actual applications of organic products in 2022 vs. 2021, which translates to a 4% increase in the average number of treated acres per application in 2022. The PURE Intel data also includes fewer California farmers reporting an organic product application in 2022 than 2021 (8,371 in 2021 vs. 7,900 in 2022), which was essentially consistent with the overall trend in the number of farms reporting applications of any type.

Adjuvants represented the bulk of organic product applications in the Golden State in the 2022 (nearly 65% of treated acres), follow by fungicides (26%) and insecticides (5%). Helena’s Kinetic® adjuvant was the most widely applied organic product in 2022 with 759 growers reporting making an application, which resulted in more than 460,000 treated acres of the product.

| Brand | 2022 Treated Acres | % of Organic Treated Acres |

| Kinetic | 465,555 | 10.6% |

| Syl-Coat | 447,442 | 10.2% |

| Miller Nu Film P | 349,906 | 8.0% |

| Freeway | 268,842 | 6.1% |

| Plant Health Technologies Vestis | 207,080 | 4.7% |

| Tri-Fol | 204,700 | 4.7% |

| Kocide 3000-O | 188,515 | 4.3% |

| Nu-Cop HB | 172,242 | 3.9% |

| Entrust SC | 155,808 | 3.6% |

| Oroboost | 94,538 | 3.4% |

Bob West is the Direct of Meister Media’s data business. For more information about this data or for more details about Meister’s PURE Intel+ and PURE Intel+ PCA (patent pending) products, contact him at 440-602-9129 or [email protected].

PURE Intel is a trademark of Meister Media Worldwide. PURE Intel+ PCA is patent pending.

About PURE Intel

Meister Media’s PURE Intel platform offers subscribers comprehensive insights into California’s specialty agriculture market by aggregating monthly crop protection product application data from approximately 20,000 California farms and providing that data through a user-friendly, web-based platform that enables subscribers to customize their data queries.