by Bob West

The early-season look at the California markets offers a mixed bag of results, based on data published within Meister Media’s PURE Intel™ platform through the first four months of the year. Overall, California farmers have reported 4 percent more applications and 4 percent more treated acres of restricted use products compared to the first four months of 2024. (It’s worth noting that 2024 figures through April were 15 percent ahead of 2023.) However, nearly all of the 2025 growth thus far has occurred within the tree nuts category while treated acres in most of the other key product categories is flat to slightly down to 2024.

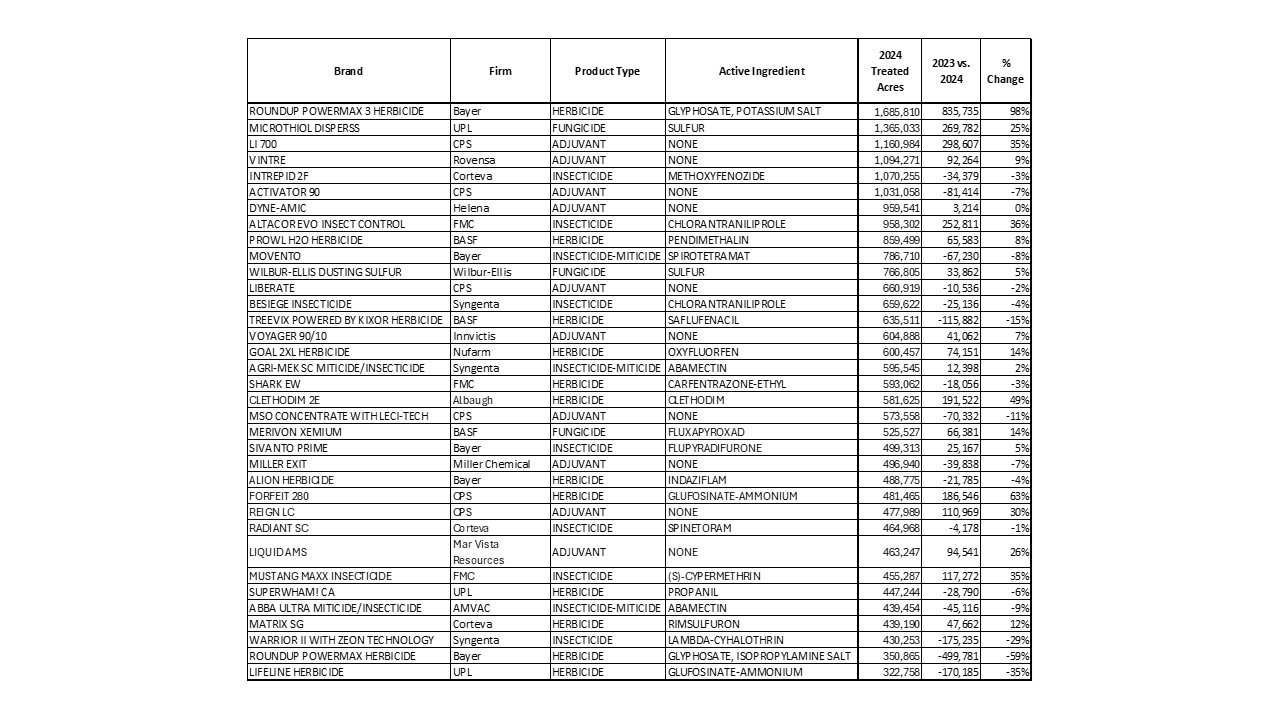

| Crop Group | Treated Acres through April | Treated Acres 2025 vs. 2024 |

| Tree nuts | 10.2 million | 19% |

| Grapes | 2.9 | -2% |

| Forage / Fodder | 2.6 | -10% |

| Citrus | 1.3 | 14% |

| Stone fruit | 1.1 | 9% |

| Leafy vegetables | 1.1 | -4% |

| Small fruit / Berries | .826 | -1% |

| Grains / Cereals | .813 | 0% |

| Root & tuber vegetables | .573 | -20% |

| Fruiting vegetables | .564 | -9% |

Overall, these top 10 crop groups accounted for 21.2 million treated acres through the first reporting of growers’ pesticide use reports (PURs) compared to 20.7 million treated acres in January – April of last year. Not surprisingly, almonds represent nearly all of the growth within the tree nuts category with roughly 1 million more treated acres to start 2025. This growth in almond applications has occurred primarily in fungicides and adjuvants although treated acres of herbicides have also climbed year over year.

Bob West is the Director of Meister Media’s data business. For more information about this data or for more details about Meister’s PURE Intel+ and PURE Intel+ PCA products, contact him at 440-602-9129 or [email protected].

PURE Intel is a trademark of Meister Media Worldwide.

About PURE Intel

Meister Media’s PURE Intel platform offers subscribers comprehensive insights into California’s specialty agriculture market by aggregating monthly crop protection product application data from approximately 20,000 California farms and providing that data through a user-friendly, web-based platform that enables subscribers to customize their data queries.