By Bob West

With most California farmers’ crop protection activities wrapped up for 2022, the December update to Meister Media’s PURE Intel+ platform paints a clear picture just how much California farmers’ crop protection activity changed during yet another drought-plagued year.

We estimate that California’s farmers will produce 88 to 92 million treated acres of restricted-use product applications in 2022, which represents a decrease of 2 to 4% from 2021 levels and a 13 to 15% drop from the high of 105 million treated acres in 2019.

The data certainly includes some bright spots for crop protection suppliers:

- Adjuvants comprise the largest product category in terms of treated acreage by far, and treated acreage of these key products will essentially finish the year flat to last year.

- Insect pressure clearly wasn’t as impacted by the lack of rain as insecticide treated acreage is only 1% below 2021 levels and miticide applications covered 3% more acres in 2022 than in the previous year.

- Treated acreage of insect growth regulators jumped roughly 12% in 2022 vs. 2021.

- Treated acreage for defoliants is up more than 30% this year, thanks largely to a sizeable increase in planted acreage of cotton in the Golden State.

The largest year-over-year declines occurred in the fungicide market, which stands to reason given the lack of rainfall. We estimate that final fungicide treated acres will be between 17 million and 17.5 million for 2022 compared to 18 million in 2021. PURE Intel+ tracks applications for 224 different crops, and treated acreage of fungicides only increased from 2021 to 2022 on a few: table grapes, pistachios, processing tomatoes, pears, tangerines and potatoes.

Unfortunately, these increases were generally minor and nowhere near large enough to offset the significant declines of fungicide applications on key crops such as almonds (down 900,000 treated acres vs. 2021), rice (down 120,000 treated acres), raisin grapes (down 80,000 treated acres), head lettuce (down 60,000 treated acres) and walnuts (down 50,000 treated acres).

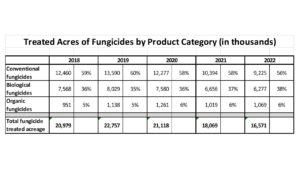

PURE Intel+ reporting also tracks applications of conventional vs. organic vs. biological products, and it’s interesting to note that farmers appear to be turning to biological and organic fungicides with increasing frequency (see chart). Treated acreage of organic fungicides (defined as those carrying an OMRI designation on their label), has actually increased more than 10% over the past five years while the overall fungicide market has decreased more than 20% during the same timeframe. And the percentage of fungicide treated acreage comprised of biological products has increased from 36% in 2018 to 38% in 2022.

Bob West is the Direct of Meister Media’s data business. For more information about this data or for more details about Meister’s PURE Intel+ and PURE Intel+ PCA (patent pending) products, contact him at 440-602-9129 or [email protected].

PURE Intel is a trademark of Meister Media Worldwide. PURE Intel+ PCA is patent pending.

About PURE Intel

Meister Media’s PURE Intel platform offers subscribers comprehensive insights into California’s specialty agriculture market by aggregating monthly crop protection product application data from approximately 20,000 California farms and providing that data through a user-friendly, web-based platform that enables subscribers to customize their data queries.